Global investment bank JP Morgan is not optimistic about the price of Bitcoin heading into July as the threat of sell pressure looms on the horizon.

Bloomberg reports that JP Morgan strategists are not lifting their bearish Bitcoin outlook, as a large Grayscale Bitcoin fund, GBTC, prepares to unlock more shares, giving BTC holders a chance to sell their coins.

Say JP Morgan strategists,

“Despite this week’s correction we are reluctant to abandon our negative outlook for Bitcoin and crypto markets more generally. Despite some improvement, our signals remain overall bearish.”

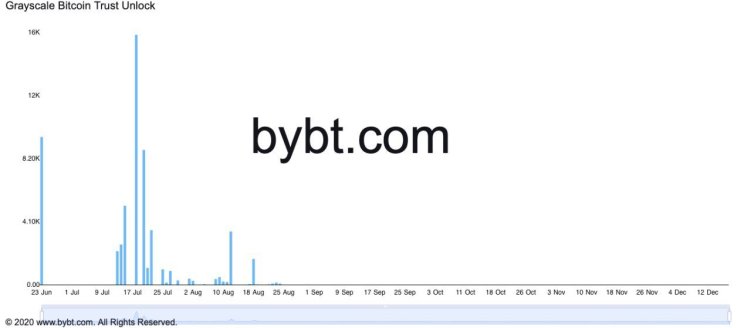

CoinShares CSO Meltem Demirors is also wary of the quantity of Bitcoin shares that will be unlocked over the next month, cautioning crypto investors not to overlook the significance of the selling pressure the unlock could introduce into the market.

“One thing we haven’t discussed yet – the Grayscale GBTC unlock schedule is looking really crusty.

From mid-April to mid-June, 139,000 Bitcoin worth of shares have unlocked. There’s another 140,000 Bitcoin worth of shares that will unlock through the end of July… yeesh.”

JP Morgan strategists warn that they are unsatisfied with Bitcoin’s slight dip below $30,000 this Tuesday and expect a dip to around the $25,000 level before a true bottom can be found.

“It would still take price declines to the $25,000 level before longer-term momentum would signal capitulation.”

The Grayscale Bitcoin Trust currently has $21 billion worth of assets under management or roughly 692,000 Bitcoin shares. Each share represents 0.000941003 BTC. Accredited investors who buy GBTC shares can only sell their holdings after a six-month lock-in period.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix