The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In the below edition of the Daily Dive we took a fresh look at the accumulation taking place using on-chain metrics and data.

In last Friday’s Daily Dive, we examined the capital inflows that had seemingly come to a halt on the Bitcoin network, using realized market capitalization.

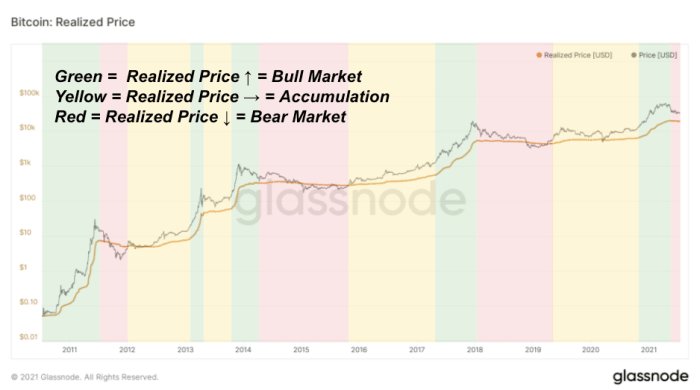

The history of the realized price/capitalization metric in particular is one that we decided should be covered in further detail. In hindsight, throughout the history of the Bitcoin network, the realized price has presented a fantastic signal as to the phase of the bitcoin market cycle.

While market price is set at the margin, realized price can serve “fair value” of the market price of bitcoin, valuing each UTXO at the price quoted when it was last moved. In a very broad sense, over extended periods of time, when:

- Realized price is increasing, bitcoin is in a bull market

- Realized price is plateauing, bitcoin is in an accumulation phase (preceding a bull market)

- Realized price is decreasing, bitcoin is in a bear market

The chart below displays this dynamic.

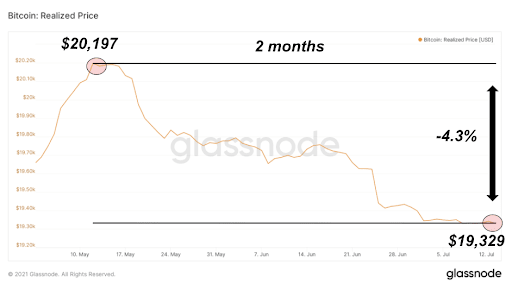

As you can see, realized price has been drawing down since the month of May, albeit slowly, but this historically has marked the start of a prolonged bear market. Is it premature to use a two month view of realized price to call a bear market? Most likely so, but it still is a notable trend.

Here is a closer look at the recent downtrend in realized price.

Is bitcoin in a bear market? Truth be told, it is impossible to know, but the decrease in realized price from a peak of $20,197 on May 12, 2021, to $19,329 today historically would be how the start of a bear market would look like.