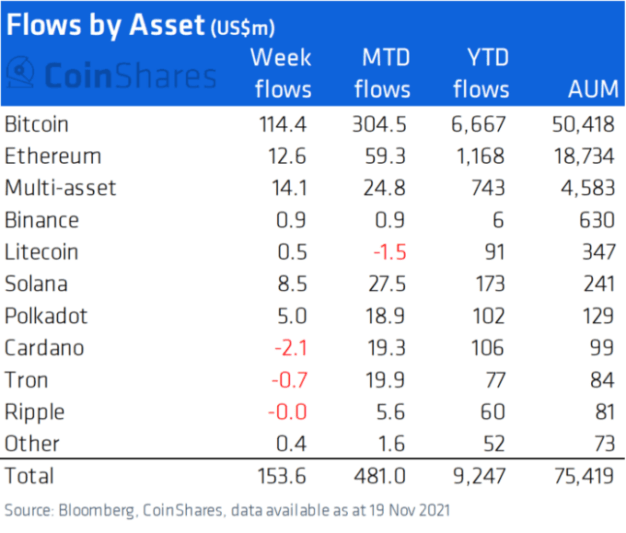

Leading digital asset manager CoinShares says institutional investors are taking the opportunity to buy the dip on Bitcoin (BTC), Ethereum (ETH) and Solana (SOL).

According to the firm, Bitcoin’s 12% dip amid the overall crypto market correction has not dampened investor sentiment.

“Digital asset investment products saw inflows totaling US$154m last week, with the most recent price correction, where Bitcoin prices fell by 12% over the week, seemingly not impacting the positive investor sentiment.”

Despite the dip, CoinShares reports that BTC saw inflows totaling over $100,000,000 last week alone, helping it remain the largest crypto within investment products.

“Bitcoin continues to see the majority of inflows, totaling US$114m last week. This has helped it retain an assets under management (AuM) share of 67% over the last month amongst investment products.”

Currently, BTC is trading at $57,505.

The report also dives into top smart contract platforms like Ethereum, Solana and Cardano (ADA).

“Ethereum saw inflows totaling US$14m last week, marking its fourth consecutive week of inflows totaling US$80m…

Inflows into world computer assets suggest that investors favor Solana. By measure of total inflows over the last month, Solana has seen inflows totaling US$43m over the last month versus Cardano at US$23m.”

Despite Cardano’s recent massive inflows, digital asset management firm notes that ADA saw millions in outflows last week.

“Some altcoins, for the first time in many months saw minor outflows, such as Cardano which saw outflows totaling US$2.1m.”

ADA is exchanging hands at $1.80 at time of writing.

You can read the full CoinShares report here.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Philipp Tur/Andy Chipus/pikepicture/WhiteBarbie